Visa has launched ‘Onchain Analytics Dashboard’ in collaboration with blockchain data provider Allium Labs to make stablecoin activity easier to understand.

In a bid to provide transparency and accessibility to blockchain data, the dashboard aims to be a go-to resource for those interested in stablecoins. It offers a comprehensive overview of various aspects, including information on active users, volumes by coin and blockchain, transaction sizes and a continuously evolving set of stablecoin metrics.

This project was started due to there being a lot of “noise” in and around stablecoin data, according to Cuy Sheffield, Head of Crypto at Visa.

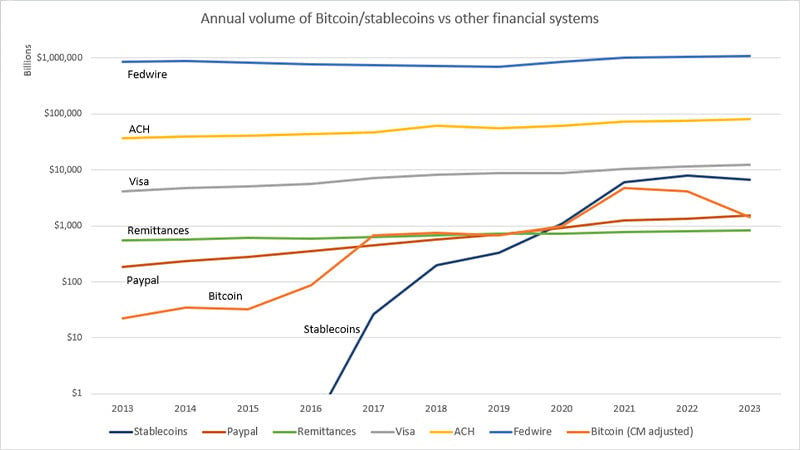

In a blog post announcing the dashboard, Sheffield highlighted a line chart that had been shared on social media under the headline “stable[coin]s are catching up to established settlement networks”.

Sheffield described the chart as “interesting” but goes on to say “but I’d argue that this comparison doesn’t really tell the full story”.

Stablecoins stand out from other payment and settlement networks due to issuance and transfer over public blockchain networks. This distinctive feature makes stablecoin transaction data readily available in real-time to anyone interested.

However, despite this transparency, extracting and structuring this data demands a deep understanding of blockchain mechanics. This task becomes even more daunting considering the diverse range of blockchains that host stablecoin transactions, each with its unique intricacies.

Therefore, Visa wanted to create a solution. So far, using the dashboard, Sheffield has found three notable trends.

Firstly he found that stablecoin supply is approaching all-time highs. The total demand has picked back up in 2024, with circulating supply approaching $150bn.

This makes sense with big financial institutions launching native stablecoins. PayPal became the first financial institution to launch its native stablecoin with PYUSD and more recently, cryptocurrency exchange Ripple Labs announced its intention to launch a stablecoin this year.

Secondly, Sheffield has reported that there is steady growth of monthly active stablecoin users.

He said: “We are seeing growth in regular users of stablecoins, with 27.5 million monthly active users across all chains.”

Furthermore, he shared that there is a discrepancy between total transfer volume vs bot-adjusted transfer volume.

Looking forward, Visa has stated that it welcomes a conversation on what could improve the tool, inviting people to give feedback.